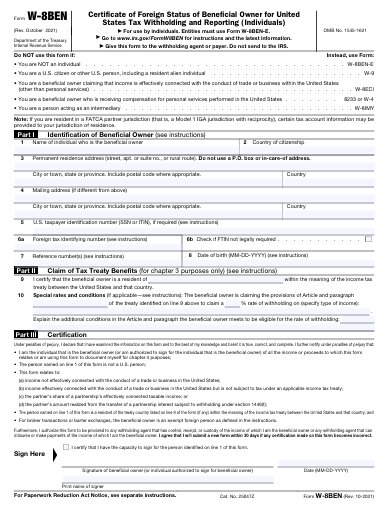

Form W-8 and Form W-9 assistance

Support for internal Forms W-8 and W-9

Guidance on how to properly complete Forms W-8 and Forms W-9. This will reduce

withholding exposure and simplify third party based communications. Forms W-8 and W-9

are continuously requested by financial institutions and third parties, having them ready

for distribution will ease your compliance burden.

Support for user-provided Forms W-8 and W-9

Assistance with the review of third-party forms that the business receives. User-provided forms can be complex

due to the withholding rates and other requirements. Incorrect forms can lead to penalties, difficult client communication, and wasted time.

Character of Payment Determinations and Sourcing Analysis

Guidance can be provided, or a review can be conducted of any of your payments to assist in determining how the payment should be classified. Payment classifications can be confusing as set forth by the rules and can have a material impact on form collection, withholding, and reporting. For payments to foreign persons, the determination of the source of income is an additional complexity.

Withholding and Deposit Guidance

Assistance with withholding rate requirements can be provided. For deposits with the IRS, guidance on the EFPTS and Fed Wire process is available.