Reporting Compliance

Managed Reporting of Electronic Returns

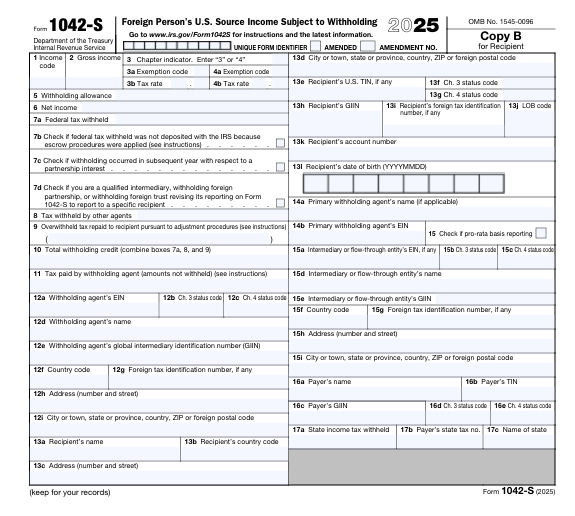

Electronic reporting of U.S. source FDAP payments to foreign persons on Form 1042-S, Foreign Person's U.S. Source Income Subject to Withholding.

Electronic reporting of consolidated return Form 1042, Annual Withholding Tax Return for U.S. Source Income

of Foreign Persons, as a trusted IRS Electronic Return Originator (ERO) - in process.

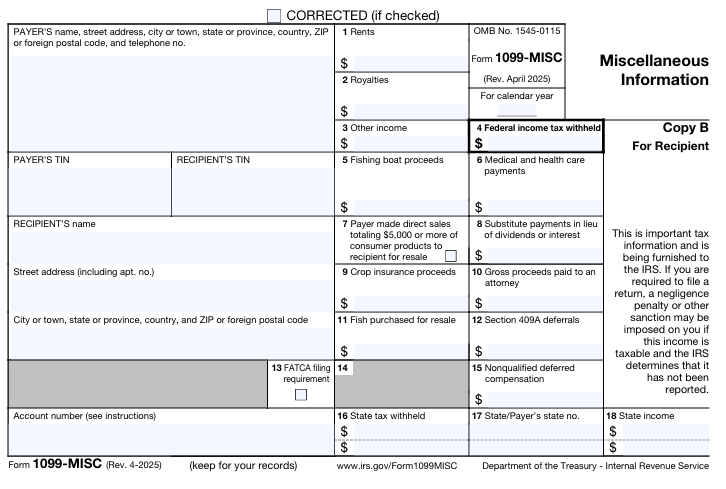

Electronic reporting of Form 1099, such as Form 1099-MISC or Form 1099-NEC.

Return templates, prior to filing, can be reviewed as a standalone offering or as part of the electronic form filing.